Home loan comparison

Rates correct as of . View disclaimer.

Powered by:

Savings.com.au

Savings.com.au

Savings.com.au Pty Ltd ACN 161 358 363 | Australian Financial Services Licence and Australian Credit Licence 515843

Lenders mortgage insurance calculator

Disclaimer:

This calculator should be used as an estimate only. The results are based on the information you put into the calculator. Results are based on a 30 year loan term. The calculator does not consider a number of factors which influence Lenders Mortgage Insurance, such as a borrower’s financial situation and assets, and the security property type.

What is Lenders Mortgage Insurance?

LMI is insurance that covers the lender, rather than the borrower. The primary purpose is to decrease the chance of any financial loss if the borrower is unable to continue paying their loan.

It's important not to confuse LMI with Mortgage Protection Insurance, which covers borrowers for their mortgage in case of uncontrollable events such as death, sickness, disability or unemployment.

In the event a borrower can’t pay their home loan repayments and defaults on their mortgage, LMI helps the lender recover the amount that was borrowed by repossessing the property the home loan is tied to.

However, the value depreciation of a property can be a risk to the lender, as they may suffer a loss even after the repossession of the house. Due to this risk being covered by LMI, lenders are more willing to approve mortgages with higher loan to value ratio (LVR).

How is Lenders Mortgage Insurance Calculated?

LMI can be calculated as a percentage of the total mortgage amount. The premium amount will depend on your LVR and how much money you wish to borrow.

LMI can also vary depending on what type of borrower you are. First-time borrowers usually pay higher LMI costs than existing borrowers, even if the LVR and amount of the loan are the same.

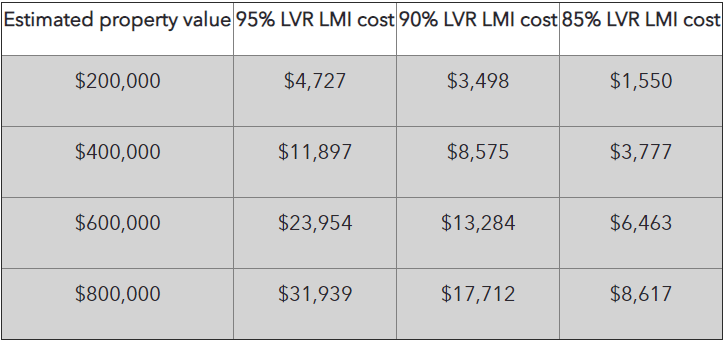

See the below table for some LMI premium estimates based on LVR and loan amount:

LMI premiums for first home buyers

Source:Savings.com.au's Lenders Mortgage Insurance Calculator. Prices including GST but excluding stamp duty. Based on a loan term up to 30 years.

Lenders Mortgage Insurance FAQ

Most lenders usually waive LMI for borrowers within certain line of work, such as lawyers, athletes, accountants and entertainment professionals, as long as their LVRs doesn’t exceed 90%.

Most lenders will offer you the option to add your LMI to the total loan amount you borrow, however you will be charged interest on this amount, and may result in a higher monthly repayment.

LMI is required when your loan deposit is lower than 20% of the total amount. It's not necessarily bad as it aims to protect your lender in the event you default on your repayments.

Base criteria of: a $400,000 loan amount, variable, fixed, principal and interest (P&I) home loans with an LVR (loan-to-value) ratio of at least 80%. However, the ‘Compare Home Loans’ table allows for calculations to made on variables as selected and input by the user. All products will list the LVR with the product and rate which are clearly published on the Product Provider’s web site. Monthly repayments, once the base criteria are altered by the user, will be based on the selected products’ advertised rates and determined by the loan amount, repayment type, loan term and LVR as input by the user/you. Rates correct as of 15 August 2025.

^The addition of offset sub-account means your comparison rate will change.

Powered by:

Savings.com.au

Savings.com.au

Savings.com.au Pty Ltd ACN 161 358 363 | Australian Financial Services Licence and Australian Credit Licence 515843